A good online reputation is critical for any business – it builds trust and enhances credibility, which attracts new clients. This is especially important for accountants, who are trusted with sensitive financial information.

Retaining a strong brand image is vital, with digital marketing being a key role in this challenge. Managing your online reputation means maintaining several important channels.

Whether you are part of a large firm or working independently, your online presence should reflect your expertise and professionalism. A well-managed online reputation can attract new clients, retain existing ones and establish trust in your services.

Find out how to navigate the essentials of online reputation management, with local search and social media of upmost importance.

Why your online reputation is key!

Your online reputation is often the first impression potential clients will have of your services. For accountants, where trust and professionalism are paramount, a robust online reputation can be the difference between thriving and merely surviving. It helps establish authority in your field, distinguishing you from competitors.

Effective online reputation management ensures that when your firm is searched for, the results reflect a well-rounded portrayal of your expertise, client satisfaction and industry authority. Positive reviews and a strong presence on relevant online platforms can significantly influence the decision-making process of potential clients. Moreover, it can aid in mitigating the impact of any negative feedback by promoting a continuous stream of positive interactions and testimonials.

Maintaining a vigilant approach to your online reputation not only protects your firm but also actively works to enhance your market position by constantly updating potential and current clients about your proficiency, reliability and dedication to client satisfaction. This ongoing commitment to excellence is crucial in fostering long-term client relationships and establishing a reputable brand identity in the financial sector.

Conversely, a neglected or poorly managed online reputation can have detrimental effects. For example, unresolved negative reviews, inaccurate business information or a lack of engagement on social media can lead potential clients to question your professionalism and reliability. Additionally, an absence of regular updates or a poorly designed website can give the impression of a firm that is out of touch with modern practices or disinterested in client interaction. Such perceptions can drive potential clients towards more digitally savvy competitors and significantly hinder your firm’s ability to attract new business.

To start, here are two areas you must prioritise to impress potential clients…

1. Google Business

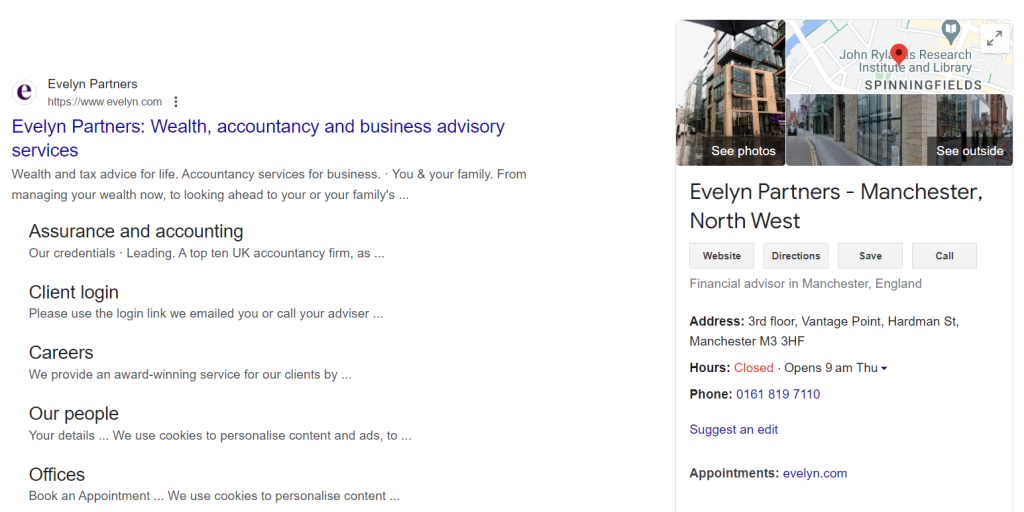

When it comes to reputation management for accountants, your Google Business profile is a powerful tool for online visibility and brand image. For example, take a look at Evelyn Partners’ profile:

Once you have created or claimed your Google Business account, you should begin by ensuring all information is accurate. This might include checking your business name, address, phone number and operating hours.

Remember to verify your profile

Keep in mind that before your business profile goes live, you first need to verify it. The process is straightforward. Google will send you an email with a verification postcard, which can take up to five business days to arrive.

By completing this step, you will be able to access important tools including analytics, insights and reviews.

Optimising your profile

You want to ensure you have all bases covered on your Google Business profile. This can not only help new and existing clients understand the services you offer but also improve your local search ranking.

Here are some key areas to optimise:

- Description: Ensure you have added a description to your page. You only have 750 characters, so use your words wisely. Although not a ranking factor, make sure you accurately include the search terms related to your accountancy firm – such as accounts, bookkeeping and tax support.

- Categories: When selecting your categories, make sure to choose relevant categories that accurately describe your services within accounting.

- Service listings: List each of the accounting services you offer. The more detailed the description, the easier it will be for potential clients to understand what you offer.

- Regular updates: you should aim to post regular updates about your services. This might include general updates, industry news, or special offers. Doing this keeps your profile active and engaging for users.

Adding photos to your Google Business Profile

Photos have a large impact on the performance of your profile. Good photos mean more traffic, which in turn means more potential clients for your services! Here are some tips to keep in mind when adding photos:

- Quality: Always add high-quality photos that look professional, reflecting your brand.

- Update: You should add new photos regularly. This shows the Google index that you are interacting with your profile and keeping it relevant.

- Searches: Adding more photos means more search results for your profile.

- Credibility: Nothing stands out and builds your reputation as a business quite like real photos. Yes, it can be a pain to organise, but it makes such as big difference. If you want to go above and beyond, organise photos of your team and office space. Here’s a fantastic example of a team photo by Taxscouts:

Managing reviews

Beyond analytics and insights, one of the most powerful tools Google Business Accounts offers is the chance to manage your reviews. You can think of reviews as a key channel that affects your reputation.

You should aim to encourage any satisfied clients to leave a positive review. When a new review has been submitted, you should aim to respond promptly. This is true for both positive and negative reviews.

If you have received a negative review, you can leave a thoughtful response. Responding to criticism shows your commitment to client satisfaction and can help mitigate any potential damage to your brand identity.

Share Google posts

Lastly, don’t forget to share Google Posts – a feature that businesses can use to add some personality to their local listings. This lets you share posts, much like you do on a social media platform – like LinkedIn. Take a look and see what Clear House Accountants are up to…

Social media reputation

Social media platforms can be thought of as a web of public channels that can reach a broad audience. In our modern, digital age, you must choose the right platforms and use them to maximum effect.

Choosing the right platforms

The first part of this area of reputation management begins when you create your social media accounts. Some platforms are better than others, depending on your needs or brand image. For accountants, the best platforms include:

- Facebook: Facebook is a great platform for engaging with a broad audience. You can create a range of content and long posts that outline the finer points of your accountancy business.

- LinkedIn: LinkedIn is the best platform for professional networking. It is one of the most important social media platforms for accountants, where you can connect with other firms and professionals, and find new clients.

- X (previously Twitter): X offers instant engagement and is perfect for sharing industry news or insights. It is the least important of the three but can be a handy tool if you use it right.

Building your online reputation

When using social media platforms to manage your reputation, consistency is key!

You should aim to have the same branding across all channels, including colour scheme and central message. A good strategy is to develop a content calendar to regularly post updates and engaging content.

For accountants, remember that professionalism should be a key part of your brand. You should reflect this no matter the social media platform you use. Whenever you make a post, ensure it is consistent with your brand in terms of tone and content. There are many types of content you can choose to make, but some of the most common for accountants include:

- Client testimonials: If you’ve recently had some positive feedback, you can show this to your audience to build your credibility.

- Educational posts: For accountants, this might include tips and guides on tax preparation, financial planning, or other topics relevant to your services and client base.

- Personal stories: Humanising your brand is a great way to connect with potential clients. Telling a personal story is a great way to heighten engagement.

Still stuck for ideas? Take a look at these 25 social media ideas your accountancy firms can use, with real examples.

Monitoring your social media

To keep a good reputation, you will need to actively monitor your social media channels. This means tracking mentions and comments about your business and then quickly responding to any queries or feedback.

You should aim to create positive interactions with your audience and quickly resolve any negative comments, reviews, or questions.

Want to enhance your accountancy firm’s online reputation?

Managing your online reputation can be tough. At Rapport Digital, we provide digital marketing strategies tailored for accountants. From social media management to content marketing and SEO, we can create the perfect strategy for you. Our skilled team will handle all aspects of your online presence, allowing you to focus on delivering excellent services for your clients.